|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Current Mortgage Rates with a Comprehensive Mortgage CalculatorIn the ever-evolving world of real estate, understanding current mortgage rates is crucial for making informed decisions. A mortgage calculator can be an invaluable tool in this journey. Why Current Mortgage Rates MatterThe mortgage rate you secure has a significant impact on your overall home financing costs. Even a small difference in rates can save or cost you thousands over the life of a loan. Factors Influencing Mortgage Rates

How a Mortgage Calculator WorksA mortgage calculator helps you estimate monthly payments based on various inputs. This can help you budget effectively and compare different loan options. Key Features to Use

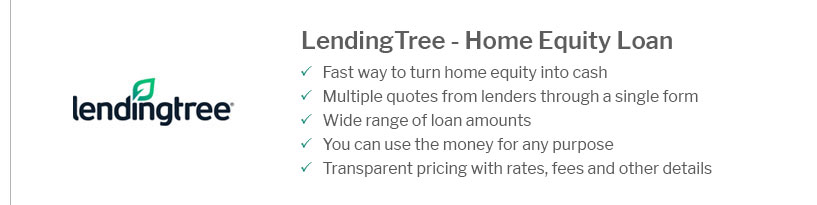

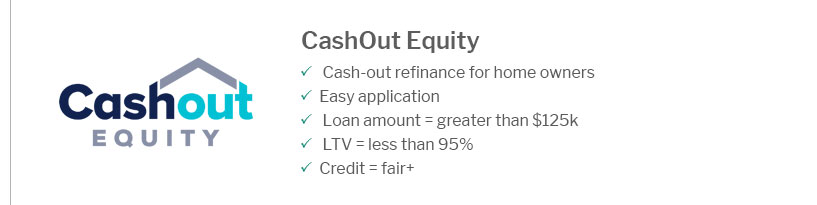

For those considering refinancing, a refinance calculator 30 year fixed can offer specific insights tailored to your refinancing needs. Exploring Different Mortgage OptionsBeyond traditional mortgages, there are various options available, such as 2nd mortgage interest rates, which can be beneficial for those looking to leverage home equity. Understanding Second MortgagesThese are loans taken in addition to the first mortgage, using your home as collateral. They're often used for home improvements or debt consolidation. FAQWhat is a good mortgage rate right now?A good mortgage rate varies based on economic conditions but typically ranges between 2.5% to 4.5% for a 30-year fixed mortgage. How often do mortgage rates change?Mortgage rates can change daily, influenced by economic factors, market conditions, and changes in government policies. Can I negotiate my mortgage rate?Yes, mortgage rates can be negotiated. It's advisable to shop around and compare offers from multiple lenders. Understanding and leveraging current mortgage rates with a calculator can empower you to make smarter financial decisions. https://yourhome.fanniemae.com/calculators-tools/mortgage-calculator

Use our free calculator to estimate your monthly payment, including taxes, insurance, PMI, HOA, down payment, interest rate, and loan term. https://www.chase.com/personal/mortgage/calculators-resources/mortgage-calculator

Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. https://www.usbank.com/home-loans/mortgage/mortgage-calculators/fixed-rate-calculator.html

Use this fixed-rate mortgage calculator to get an estimate. A fixed-rate loan offers a consistent rate and monthly mortgage payment over the life of the loan.

|

|---|